MATH: Momentum Anticipation and Trend by Homma:

Link to the last MATH article: Click the link

As technical traders, We

“Anticipate, but confirm. Wish, but only react.”

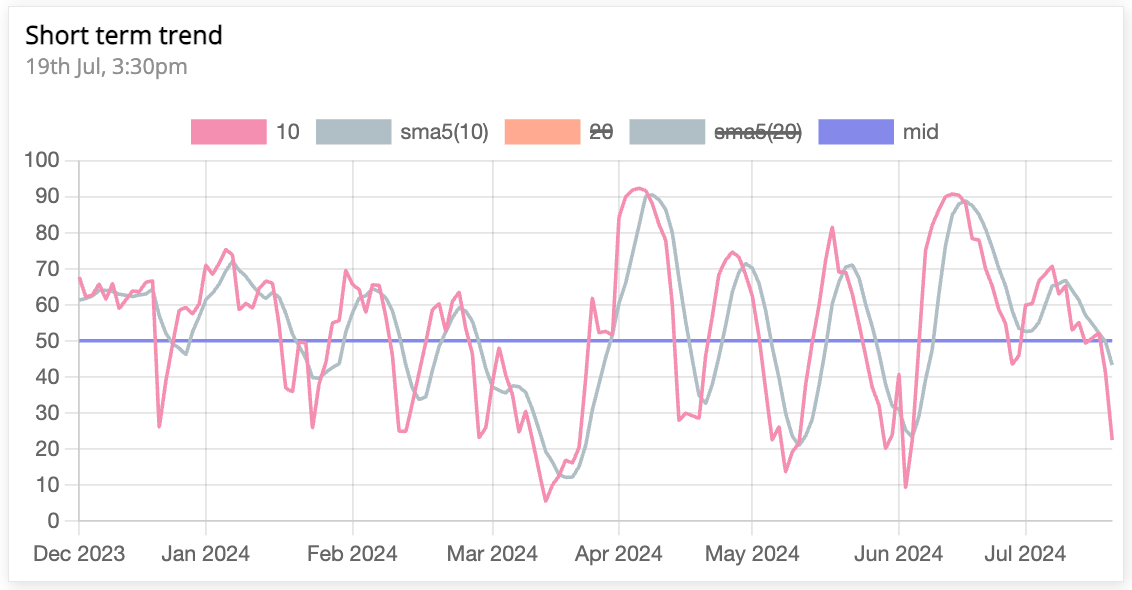

Trend:

The trend is firmly down now. The percentage of stocks trading below their 10-SMA is below 50. this is a bearish regime.

We did not bounce back from the 50% line, unlike the last time on 27th June.

Having said this, we are approaching the oversold zone (20% and below).

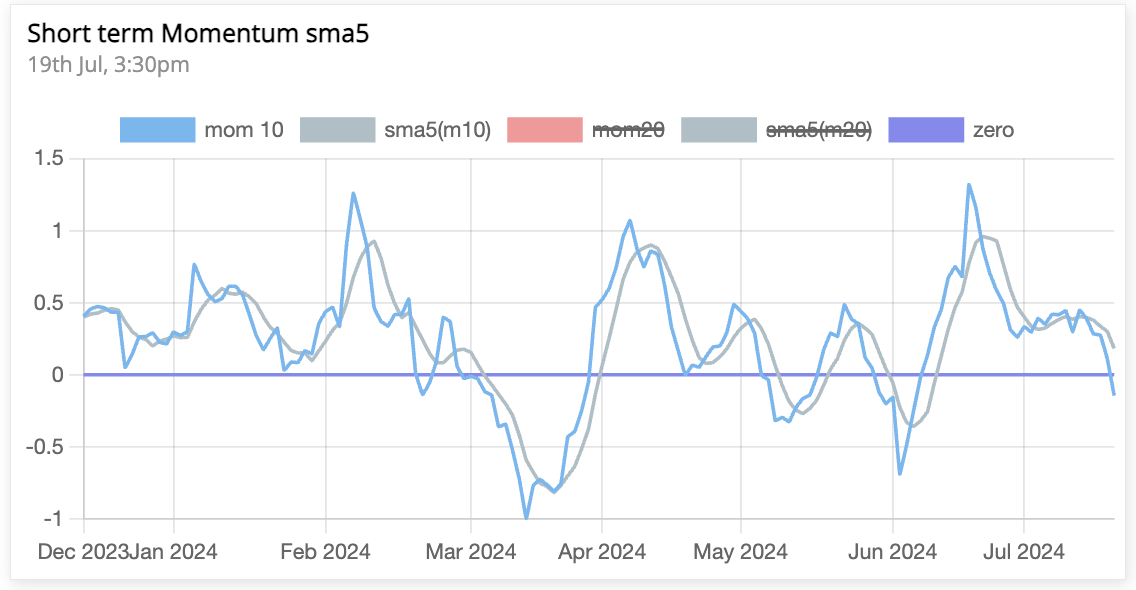

Momentum:

Similarly, the short-term momentum is also now negative.

The slope had been pointing downwards the whole week.

The probability of bounce increases the more it reaches the -1 mark.

The longer-term bias is still bullish and hence we should be ready to time the bounce.

The trigger would be the momentum plot (blue plot) crossing back above its 5-DMA (grey plot)

N50:

The index is still on an uptrend but Friday's candle was peak bearish.

Almost a bearish engulfing.

When such a bullish candle appears at the fag end of the impulse move (move in the direction of the trend), it could signal a halt of the uptrend.

N500:

Same as Nifty50

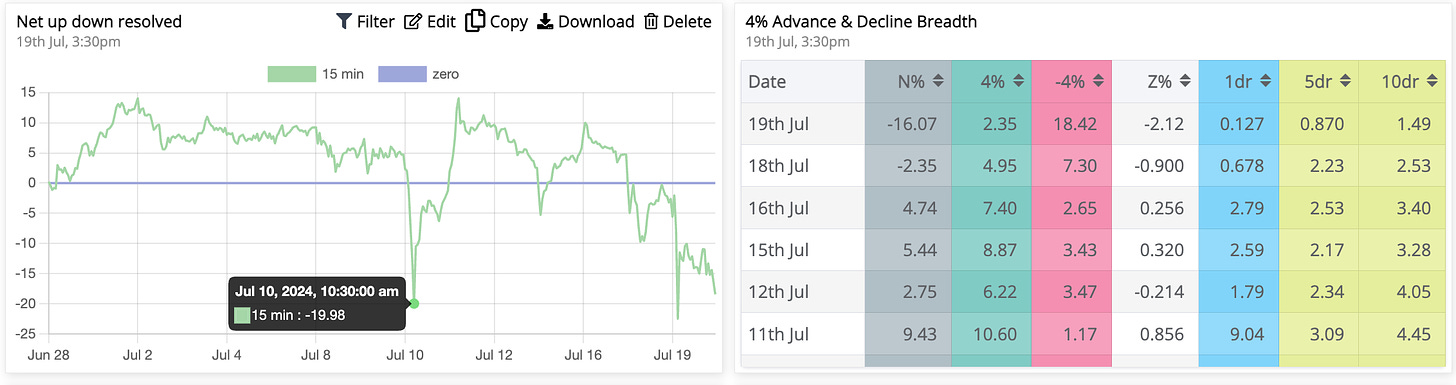

Net4% Movers:

Net movers were significantly negative on the weekly closing day.

But on the intraday chart, it shows that it is testing the previous low (made on 10th July) on the previous swing low day.

This allows me to be open to anticipating a bounce possible as long as that low is held up.

Anticipation and plan:

I believe both possibilities i.e. that of a bounce or that of the start of a longer-deeper correction are open right now.

There is nothing to worry about as a positional trader yet.

However, as swing traders, the environment is likely to activate your stoplosses.

Some strong groups such as railways and shipping did show some good bottoming signs on Friday. This creates a slight positive bias for me.

However, if the market turns more bearish and my positions go against my maximum loss, I would not be taking any chances.

Summary:

Strongest (short term and medium term):

The following groups were the strongest last week:

Telecom

IT

PSU banks

In addition to these, the following group remains strong:

Shipping

Railways

Defense

Recycling

Holding companies

Watchlists:

Keep reading with a 7-day free trial

Subscribe to The Technical Take to keep reading this post and get 7 days of free access to the full post archives.