MATH: Momentum Anticipation and Trend by Homma:

MATH last week: Click the link

The most comprehensive article on Breadth and Anticipation:

As technical traders, we

“Anticipate, but confirm. Wish, but only react.”

Trend:

Short-term: “Percentage of stocks above 10/20-DMA”

Medium-term: “Percentage of stocks above 50-DMA”

Long-term: “Percentage of stocks above 200-DMA”

In the short term, we are nearing and stabilizing at the oversold zone.

In the medium term, we are pulling back and just below the bullish zone.

In the long term, we have pulled back to the oversold zone.

Momentum:

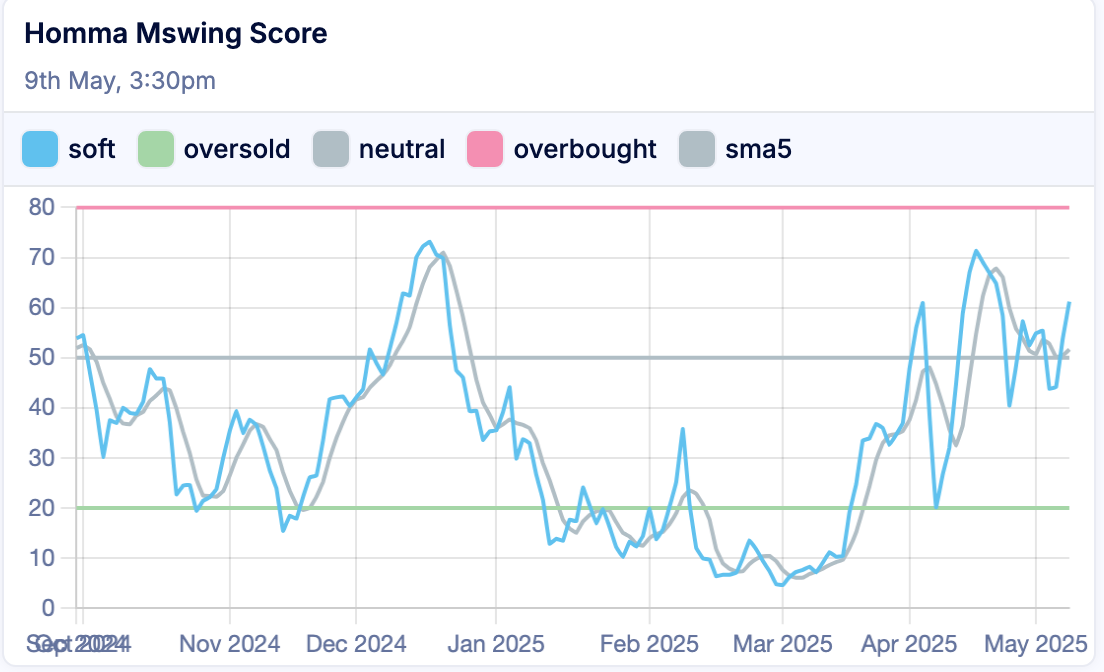

Homma Mswing Score: (basal Momentum)

Momentum is still persistent (compare with the Jan-March period).

We are sideways.

Mswing score still bullish (above 50%).

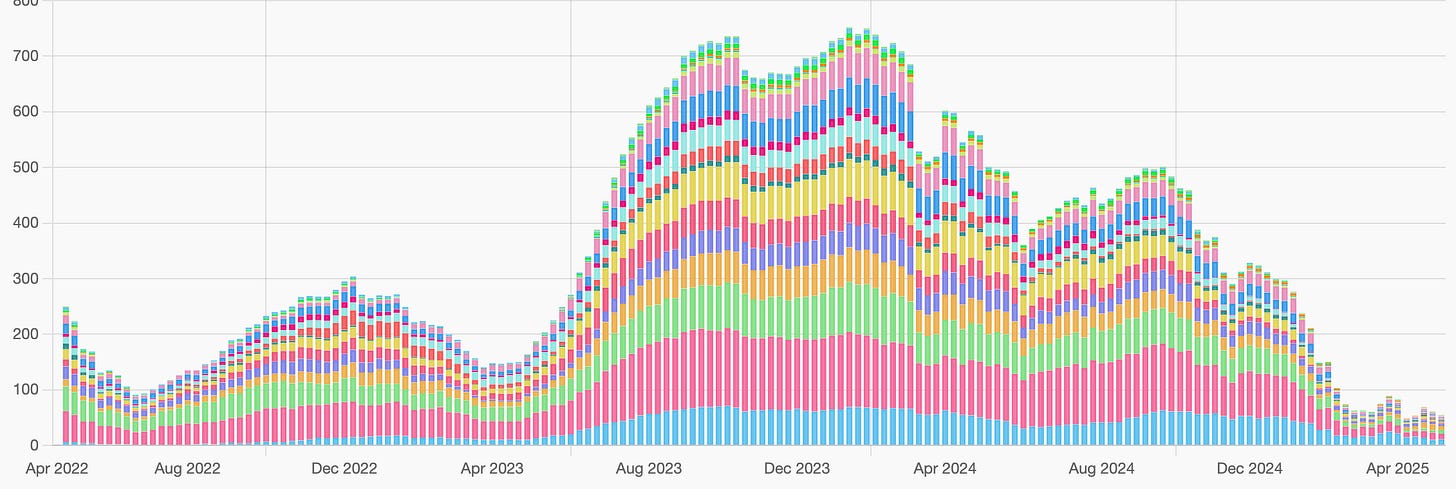

Landry Daily: (Momentum Bias for Swing Play)

Strong momentum (Momentum for swing trading) is flat and is putting a mild pullback.

Landry Weekly (Momentum Bias for Positional Play):

Weekly momentum continues to languish at the bottom. Still making Lower Highs.

Therefore, shows that there is no reason to FOMO yet.

Net4% Movers:

Negative and around the 0 mark.

Need to push to positive territory with a >10% for the Bounce.

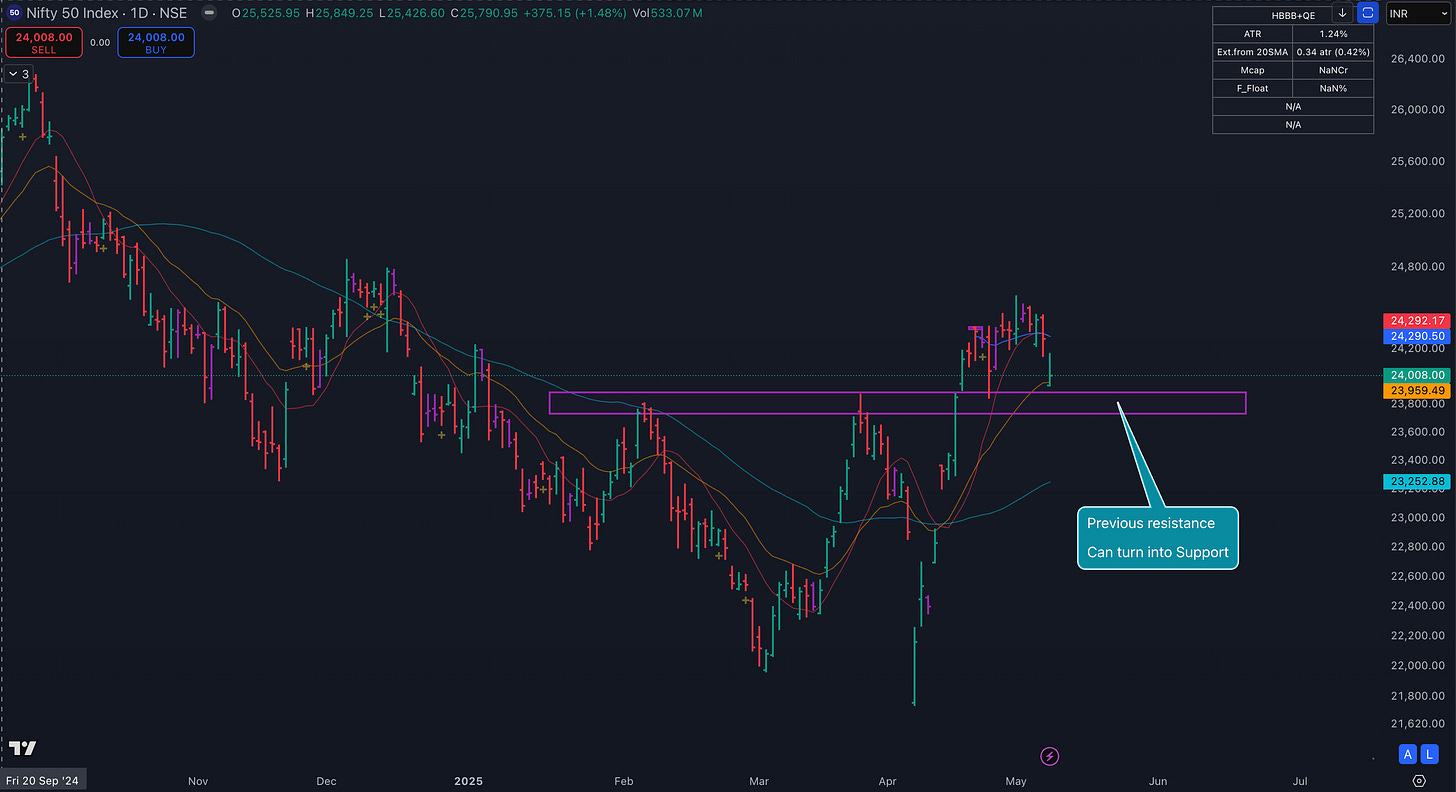

N50:

The Nifty 50 is one of the strongest indices right now.

And, Largecaps » Midcaps » Smallcaps » Microcaps

If you look at all indices, N50 has bounced off the 20DMA and is still above it, while others are below the 20DMA and bouncing around the 50DMA.

The bounce area also coincides with a previous resistance, which can turn into support.

If the banks and Financials bounce, that could lead to a bounce in Nifty too.

Anticipation:

So, we are on day 10 of the pullback and have bounced off the 50DMA at the week’s close.

How could things unfold next?

First, we are still trending down on the higher timeframe.

Now that we are on day 10 of the downswing, and the short-term breadth is at oversold, the risk-reward is better in case the bounce materializes.

But owing to the heightened volatility in the market, we need a confirmed bounce signal before putting on risk.

As long as the 50DMA is below, we have a bias of a bounce, but it’s also the last line of defence. “Nothing below the 50”.

Lastly, does having a “bias for a bounce” mean the bounce is certain?

NO. Always be open to the possibility of the opposite of what you anticipate. You will be fine as long as you wait for the confirmation of the bias before acting.

Positional bias is still NO money this week.

PS: Anticipations are often wrong, and biases should be adjusted after every candle.

If you dont know this already, I update my Market MATH every day on my website under the BREADTH section. Please check in every day post-market.

Group Strength:

Sectoral:

Banks and Financials have pulled back to the 21ema.

Defence is strong and defiant.

QSR's new strength from the lows.

Index:

Midcaps are resilient.

O&G owes Reliance.

Auto has a positive week.

Banks and Finance are pulling back but still at the top half of the table.

Watchlists:

Follow the Strongest Stocks (the RS 100 and RS 100 Liquid watchlists below):

Find Tightness candidates from Tandem Inside bars and Tandem Low ranges.

https://www.sakatashomma.com/scanners

Find my curated, actionable Pullback watchlist for the week below.

Find the HPA weekly session and actionable watchlist video below:

Keep reading with a 7-day free trial

Subscribe to The Technical Take to keep reading this post and get 7 days of free access to the full post archives.